Explainer: The green bond and why it is important for Kenya

By Mercy Asamba |

The Cabinet on Monday approved the framework which provides the missing nexus between climate action and economic development.

Kenya on Monday approved its Sovereign Green Bond framework, a financial instrument aimed at raising funds for climate action, which will strengthen links between climate initiatives and economic development.

A Cabinet dispatch stated that "the framework is anticipated to facilitate the development of new or improved climate-resilient infrastructure, secure alternative sources of food and water, and catalyse the advancement of new green technologies in climate-vulnerable sectors".

Keep reading

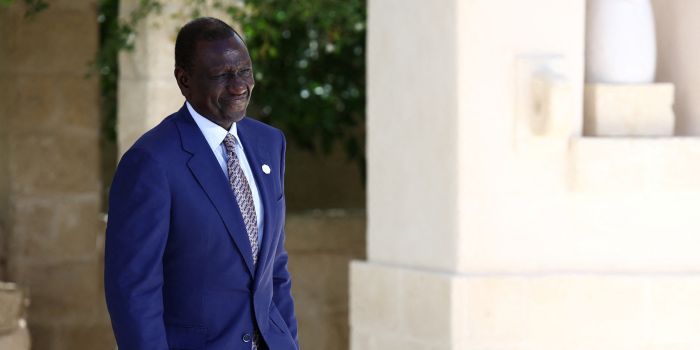

But what exactly is a green bond and why is it important for President William Ruto's efforts to champion climate.

How they work

The Nairobi Securities Exchange describes green bonds as "fixed income instruments whose proceeds are earmarked exclusively for projects with environmental benefits, mostly related to climate change mitigation or adaptation but also to natural resources depletion, loss of bio-diversity, and air, water or soil pollution".

The green bond also fund the cultivation of environmentally friendly technologies and the mitigation of climate change, according to Investopedia.

These tax-exempt bonds do not differ from any other government bond, at least not in how they work. Borrowers issue such securities to achieve funding for projects that will have a positive environmental impact.

Green bonds are typically asset-linked and backed by the issuing entity’s balance sheet. This way, they carry the same credit rating as their issuers’ other debt obligations.

They are seen as a vital element in the push for sustainability since they provide financing for environmental projects globally.

Most bonds are issued by governmental agencies or corporations.

The World Bank says its green bond raises funds from fixed-income investors to support lending for eligible projects that seek to mitigate climate change or help affected people adapt to it.

Their origin

According to the World Economic Forum, the first green bonds were issued in 2007 by the European Investment Bank. A year later, the World Bank followed suit.

“Since 2008, the World Bank has issued approximately $8 billion equivalent in green bonds through over 200 bonds in 28 currencies,” the WEF says.

Many governments and corporations have entered the market to finance green projects since then.

The green bond market has grown over the years following global green initiatives such as the Paris Agreement on Climate Change and the UN Sustainable Development Goals that facilitated its expansion.

The WEF says the US is the second-largest source of green bonds, led by the government-backed mortgage giant, Fannie Mae.

China takes the top spot currently, with a green bond issuance of more than $85 billion in 2022.

Kenya's case

On the sidelines of COP 28 in Dubai, President Ruto said he was weighing selling sovereign green bonds to fund climate projects as it was "the next thing on the horizon”.

The Green Finance Platform (GPF) states that Kenya's Green Bond Programme was launched in 2017 to promote financial sector innovation by developing a domestic green bond market.

Kenya’s first green bond was issued in October 2019.

“The Sh4.3 billion Climate Bonds Certified issuance will raise funds to provide 5,000 university students with environmentally-friendly, affordable housing in Nairobi,” GFP said at the time.

In terms of benefits for investors and issuers, the Nairobi Securities Exchange highlights the benefits for benefits of green bonds for investors and issuers. They are as follows:

Investors

- Enhanced risk management and improved long-term financial returns

- Green bonds help mitigate climate change-related risks due to changing policies such as carbon taxation.

- They give investors a chance to direct capital to climate change solutions

- Investments in green bonds matches long-term liabilities and will also help build a sustainable society for pensioners to retire into.

- Investments in green bonds have enabled institutional investors to exceed asset allocation thresholds especially when investing in emerging markets.

Issuers

- Green Bonds enable issuers raise capital from a broader base on investors.

- Lower Cost of Capital-green bonds enable issuers to raise large amounts on the capital markets at much lower costs than other instruments.

- Green bond investors invest for the long term, which is a major benefit for infrastructure projects seeking longer term investments.

- They enhance issuer reputation overall and can be part of a wider sustainability strategy

- Given the demand for green bonds, there has been strong pricing achieved by recent green bond issuance